Introduction

Sellers on the marketplace or platform need to be onboarded with Payaut before payouts can be made. Once a seller account has been created, funds can be allocated to this seller.

Seller/account holders

Sellers can be created by making an API request with the minimum required information. Once a seller account is created, funds can be allocated to them via payouts. After the KYC (Know Your Customer) checks have been completed successfully, payouts can be triggered.

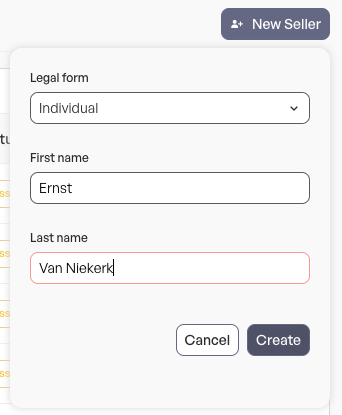

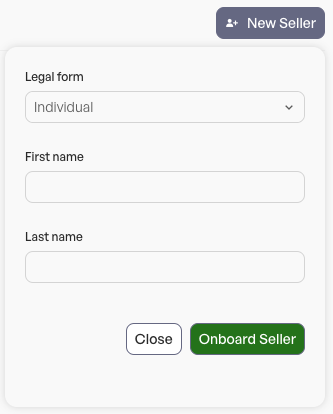

Sellers can also be created directly from the Merchant Dashboard. To add a new seller, click the “New Seller” button in the Seller’s tab, enter the legal form and name and click “Create”. Once created, additional information and documents can be provided through the “Onboard Seller” flow.

| Create Seller | Onboard Seller |

|---|---|

|  |

Legal entities

When creating a seller account, you need to specify the legal entity of the seller. We support two types of legal entities:

- Individual legal entity: an account holder should be registered as Individual when they are acting in their personal capacity (e.g. selling their own clothes, old personal car etc).

- Business legal entity: an account holder should be registered as Business when they are acting as a company / commercial seller (e.g. Payaut B.V.) or in their professional capacity even if there is no legal company incorporated (e.g. self-employed individuals).

If a seller registers themselves with an incorrect legal entity type, you can not change the legal entity type and you have to create a new seller account.

Virtual accounts

Virtual accounts are the accounts where the funds are stored within the Payaut environment. Once an accountHolder is created, it will not have a virtual account by default.

Virtual accounts can be managed via API.

On creation of the seller (or after a seller has been created) the virtual account can be created. Multiple virtual accounts can be created per seller, but we recommend to work with 1 virtual account (as we only support EUR today).

Virtual accounts cannot be deleted.

External accounts

External accounts is the bank account with the house bank of the accountholder.

- Creating: The IBAN of the seller can be added after the seller has been created. Payaut does require some form of IBAN ownership validation, which can be either

- A picture of the bank statement, including the name of the bank, the full IBAN and the full name of the seller

- A picture of the bank card, showing the IBAN in combination with the full surname of the seller.

Managing and Prioritising: Multiple external accounts can be added to a seller, in case bank accounts need to be updated. Use the “weight” field in the API request to define which IBAN should be prioritised and therefore be used for the payout. IBANs with the lowest weight will be prioritised. External accounts by default are created with weight “5000”, so when updating an external account we advise to use any amount lower than the “5000” mark.

Screening: Only after submitting the external account the KYC process will be performed. Once both the seller and the external account are approved, payouts can be performed.

Deletion: External accounts can not be deleted and can only be marked as inactive due to regulatory obligations to retain the data.

KYC Tiers

In order to accommodate with the relationship between the marketplace and the seller, Payaut offer 3 tiered levels of KYC for individuals. Depending on the business model of the platform, the risk associated to the seller and the marketplace and the processing volume we determine if a seller is applicable for a lower KYC tier, which results in less data points that are needed to pass our KYC process.

Payaut offers 3 KYC tiers for individuals. Business sellers always apply for the advanced KYC tier.

- Light KYC

- Standard KYC

- Advanced KYC

Requirements to KYC tiers

During onboarding of the marketplace or platform our compliance team decides whether a light, standard or advanced KYC tier is configured as a default. The default tier will apply for all sellers that are created.

Light KYC:

There is no formal business relationship between seller and platform, and the seller is identified as low risk.

The value of a single payout for the individual seller does not exceed 1000,- EUR

Standard KYC:

The value of the cumulative payout amount for the individual selelr does not exceed 5000,- EUR

Advanced KYC: Once Light and Standard KYC tiers do not apply, your seller will follow the advanced KYC tier. All business sellers must go through Advanced KYB checks.